AutoSwap

Concept

Providing liquidity to a concentrated liquidity pool requires two tokens in a specific ratio, based on the current market price and your selected price range (tick range). If your token amounts don’t match this ratio, part of your assets may remain idle, reducing the efficiency of your position.

AutoSwap solves this by automatically swapping the excess of one token into the other, ensuring your assets are properly balanced. This means you can add liquidity even with only one token or an unbalanced pair. No manual swaps or calculations are needed — the protocol handles it all behind the scenes.

For the full mathematical breakdown, see the AutoSwap paper.

How AutoSwap Works

When you're setting up a liquidity position, AutoSwap:

Checks your input — It compares the amounts of tokens you’ve supplied against the ratio required for your selected price range.

Calculates the difference — It determines which token you have too much of and which one you need more of.

Swaps and deposits — It swaps the excess token into the lacking one and instantly provides liquidity — all in a single, atomic transaction.

Practical Example

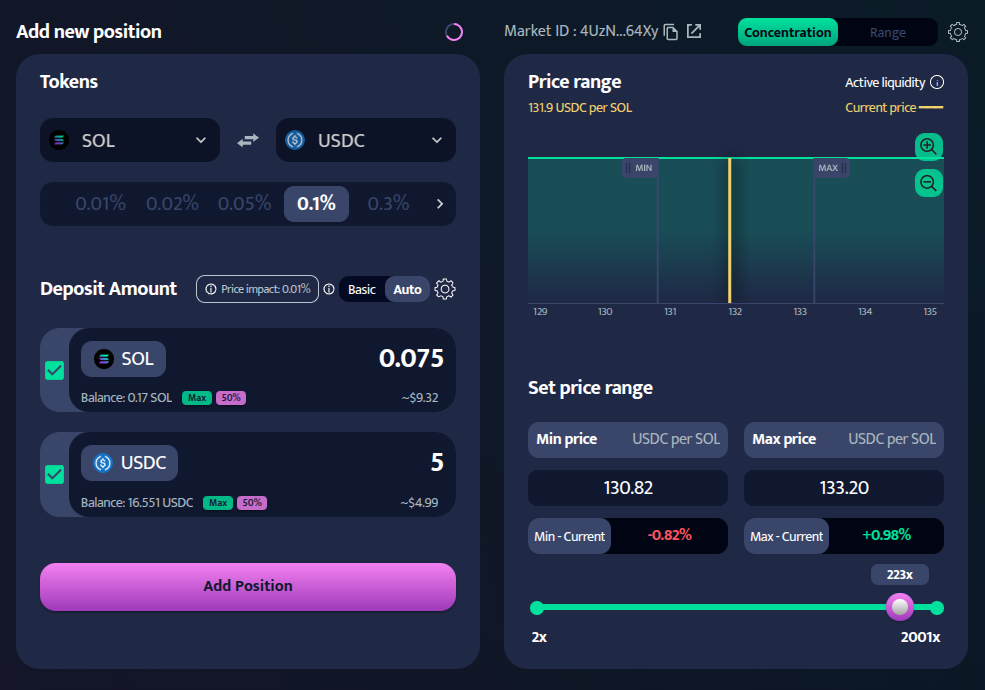

Let’s say you want to provide liquidity in the SOL/USDC pool, but your token amounts don’t match the required ratio. With AutoSwap, that’s not a problem — here’s how it works:

Select Tokens

Choose tokens you want to deposit (example: SOL and USDC).

Set Price Range

Define your desired range (example: 130.82 – 133.20 USDC per SOL).

Enter Token Amounts

Input any amounts — they don’t need to match the required ratio.

- AutoSwap Handles the Rest The system calculates and executes the necessary swap, then opens your LP position automatically. In our case, a small portion of SOL has been swapped to USDC to achieve the optimal ratio for the current price.

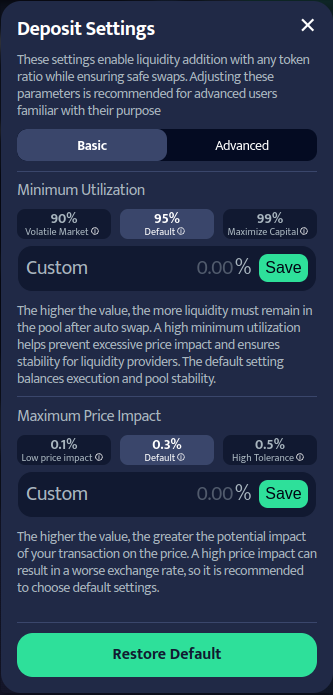

The settings can be adjusted directly in the app under AutoSwap Settings, available when adding liquidity. They are organized into two tabs: Basic and Advanced, so users can choose between a simplified or detailed configuration.

User-Configurable Options

AutoSwap offers several customization options so you can control how your liquidity is deployed:

- Minimum Token Utilization — Ensures most of your capital ends up in the LP position.

- Maximum Price Impact — Limits how much the swap can move the pool price.

- Swap Slippage Tolerance — Controls allowable price changes during the swap itself.

- Position Creation Slippage — Adds buffer for small price shifts when the LP position is finalized.

Basic Settings

1. Minimum Token Utilization

This setting determines how much of your capital must be deposited into the pool after AutoSwap. In volatile or low-liquidity pools, not all tokens may be converted optimally. This threshold prevents AutoSwap from proceeding unless most of your tokens will be used.

Available options:

| Utilization | Description |

|---|---|

| 90% (Volatile Market) | Safe for dynamic conditions. |

| 95% (Default) | Balanced for most scenarios. |

| 99% (Maximize Capital) | Near full usage, but may revert in fast-moving markets. |

2. Maximum Price Impact

Controls how much your swap can shift the market price. Useful to avoid unexpected costs, especially in smaller pools.

Available options:

| Price Impact | Description |

|---|---|

| 0.1% (Low Impact) | For stable assets or large swaps. |

| 0.3% (Default) | Balanced for general use. |

| 0.5% (High Tolerance) | Allows greater movement in exchange for speed. |

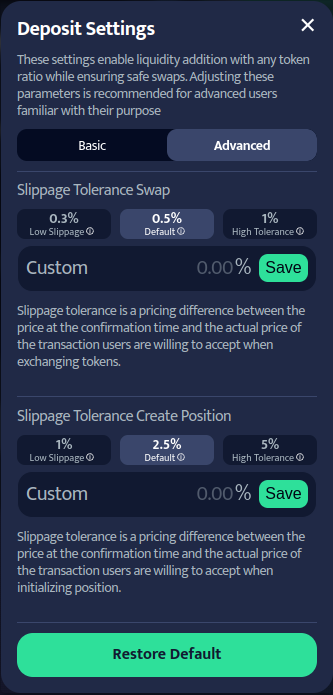

Advanced Settings

3. Swap Slippage Tolerance

Sets the acceptable deviation between the quoted and executed swap price. Useful for minimizing risk in volatile conditions.

Available options:

| Slippage | Description |

|---|---|

| 0.3% (Low Slippage) | Precise execution, more likely to revert. |

| 0.5% (Default) | Safe and flexible. |

| 1% (High Tolerance) | Best for high-speed, low-sensitivity use cases. |

4. Position Creation Slippage

After the swap, AutoSwap opens the LP position. This setting defines how much price movement is acceptable before that final step fails.

Available options:

| Slippage | Description |

|---|---|

| 1% (Low Slippage) | Ideal for tight ranges and stable markets. |

| 2.5% (Default) | Works for most token pairs. |

| 5% (High Tolerance) | Suitable for volatile conditions and wide ranges. |

Technical Details

AutoSwap is an atomic, constraint-aware mechanism for capital-efficient liquidity provisioning in the Invariant protocol. It performs a token swap and opens a liquidity position within a single atomic transaction — either everything executes successfully, or nothing changes.

How It Works

AutoSwap operates in a multi-step simulation and optimization flow:

- User input — token pair, price range, token amounts, and optional constraints (example:

maxPriceImpact,minLiquidityUsage). - Token analysis — detects imbalance between the provided token amounts and the required liquidity ratio.

- Simulation engine — simulates swap outcomes using current market data.

- Binary search — iteratively finds the optimal swap amount that meets all constraints.

- Atomic execution — once a valid configuration is found, both the swap and position creation are executed atomically.

If any condition fails during the process, the entire transaction reverts, ensuring no partial state changes or capital loss.

Simulation Modes

Same-pool simulation: Applied when the swap and liquidity position occur in the same pool. This allows precise price usage and full capital feedback control.

Cross-pool simulation: Used when the liquidity position is created in a different pool than the swap. This enables AutoSwap to support multi-market strategies.

Iterative Optimization

Rather than relying on static formulas, AutoSwap uses iterative binary search to calculate the optimal swap amount. Because token ratios and price impact are dynamic (especially under concentrated liquidity), the system:

- Simulates swap outcomes across different swap amounts.

- Measures resulting liquidity utilization and price impact.

- Refines swap size until the optimal configuration is found under user-defined constraints.

Why Predefined Pools?

AutoSwap is limited to predefined token pairs and pool routes to ensure operational safety and execution consistency. By routing swaps through vetted, audited pools, AutoSwap ensures sufficient liquidity depth and reduces the likelihood of slippage or failed transactions.