Full Range Tokenizer

Introduction

The Fullrange Tokenizer is a tool that enables the tokenization of positions established on CLMM. The fungible tokens representing our share in a position opened over the entire range from 0 to infinity, which will be compatible with other protocols, allowing for more efficient use of our LP tokens. Another feature introduced by the Tokenizer is auto-compounding. Auto-compounding will automatically compound the earned fees and reinvest them into the pools. As a result, 100% of our liquidity will always remain in the position. Additionally, the auto-compounder addresses the issue of leftover tokens, which we explain later.

How does it work?

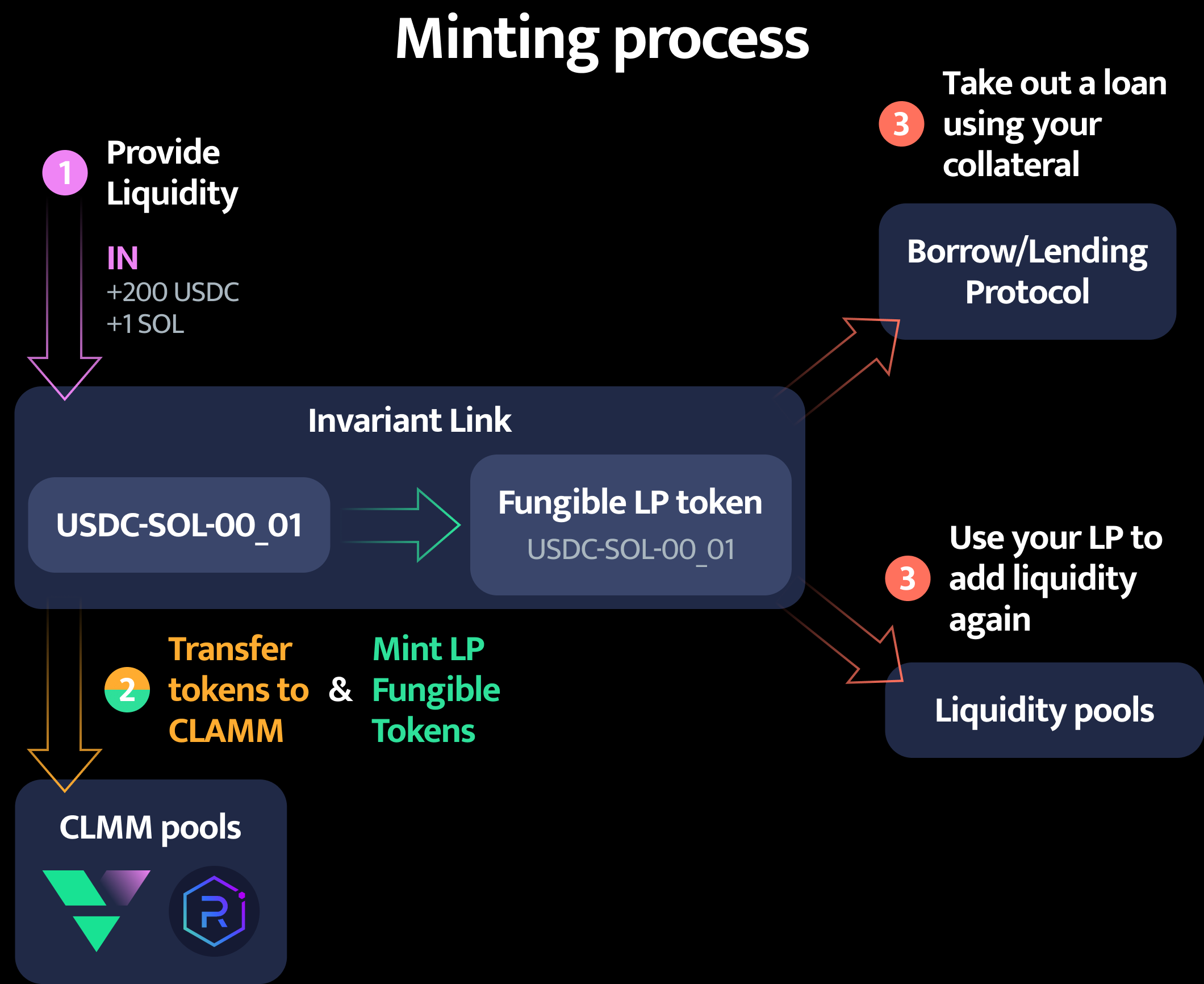

First, the user provides the tokens they want to place in the pool. The Tokenizer then increases the size of the position opened on the pool, while simultaneously minting fungible LP tokens that represent our share in that position. Once the fungible LP tokens appear in our wallet, we can manage them as we wish, such as placing them in a borrow-lending protocol or listing our position for sale on the market.

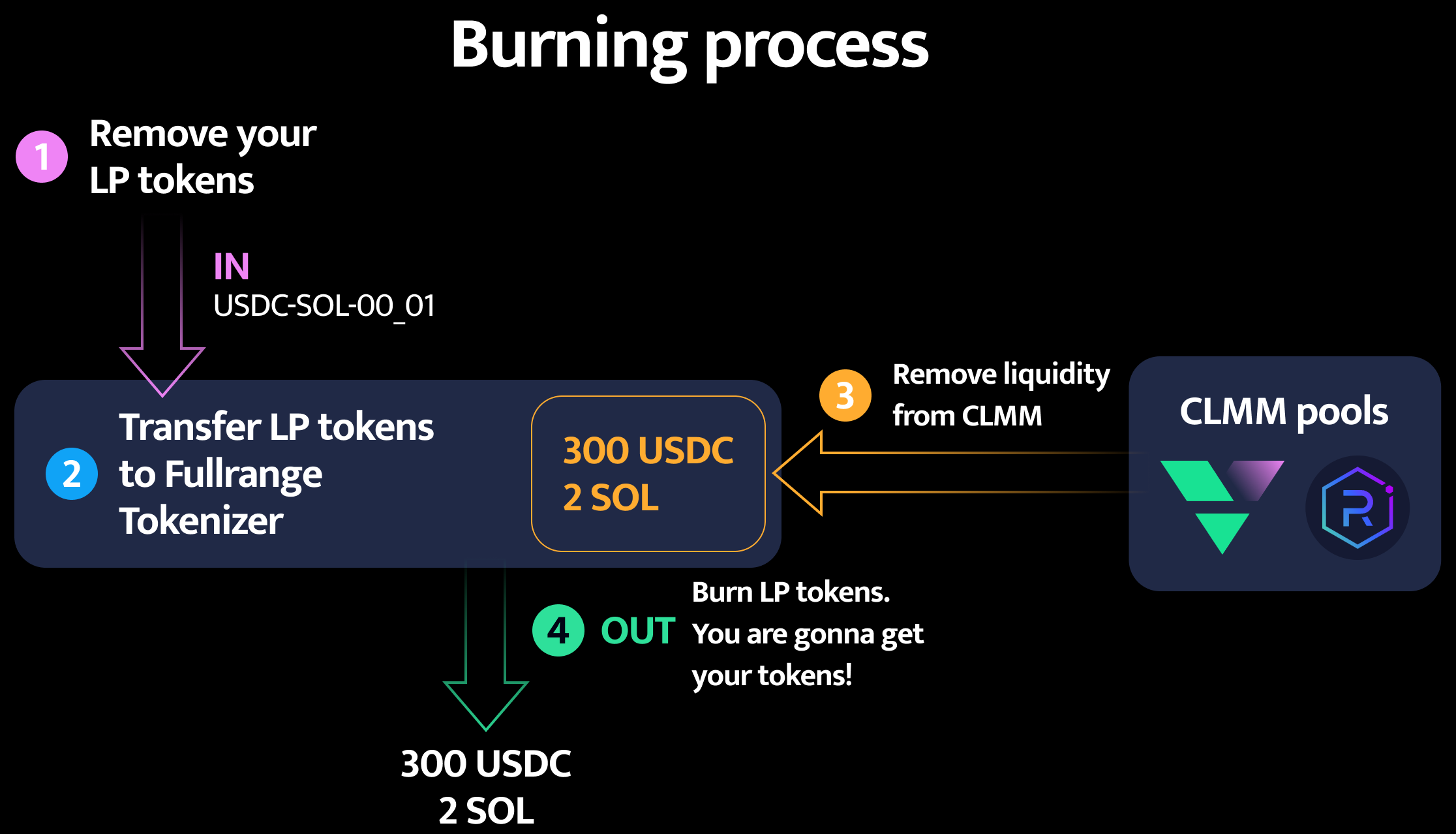

In the opposite direction, the user must send the fungible LP tokens representing their share of the position owned by the Tokenizer program, which will simultaneously burn those LP tokens and withdraw the user's original tokens from the CLMM, increased by the fees that were compounded in the position

Compounding

What kind of compounding are we talking about? One of the features of the Fullrange Tokenizer, which we mentioned earlier, is the auto-compounding of fees generated by the position. The fees are compounded every time a mint or burn occurs within a given pool. Compounding can also be triggered manually. The Fullrange Tokenizer also addresses the problem of so-called leftover tokens, which are tokens that were not reinvested into the position during compounding due to an unfavorable ratio.

In such cases, a second position is opened where these tokens are placed. The second position specifically handles any leftover unused tokens and is always denominated in one of the tokens. Based on these remnants, a single-side liquidity position is created, ranging from the current tick to the end of the possible bound, which could be 0 or infinity, depending on whether the leftovers are in token X or Y. This solution ensures the maximum possible utilization of capital. This approach is known as the "zero leftovers" solution.