Concentration advantage

Learn how to leverage concentrated liquidity, the core principle of the CLMM (Concentrated Liquidity Market Maker) model, to earn more points in the Invariant Points system.

What Is the Concentration Slider?

The concentration slider is a powerful feature that allows you to focus your liquidity within a specific price range, centered around the current market price. We created it with the aim of simplifying and speeding up the process of concentrating positions.

Full-Range Liquidity: This is the traditional AMM approach, where liquidity is spread across a wide range, from 0 to ∞. On the Concentration Slider that would be 0x.

As the slider increases concentration, the range narrows symmetrically, making your liquidity more efficient but restricted to a tighter price band.

Why Is Concentration Important?

Concentration provides a significant advantage, especially for users with smaller budgets.

- Efficiency: Highly concentrated liquidity is more efficient and earns more points compared to dispersed liquidity.

- Reward System: Invariant Points rewards positions with liquidity concentrated around the current market price.

A well-concentrated position can dramatically increase your point earnings, leveling the playing field against larger liquidity providers.

Difference could be asthonishing

The potential point differences between low and high concentration levels are staggering.

- A $100 position with 2x concentration might earn 10 points/day.

- The same $100 position with 2001x concentration can earn 10,000 points/day.

This 1,000x difference is directly proportional to the concentration multiplier.

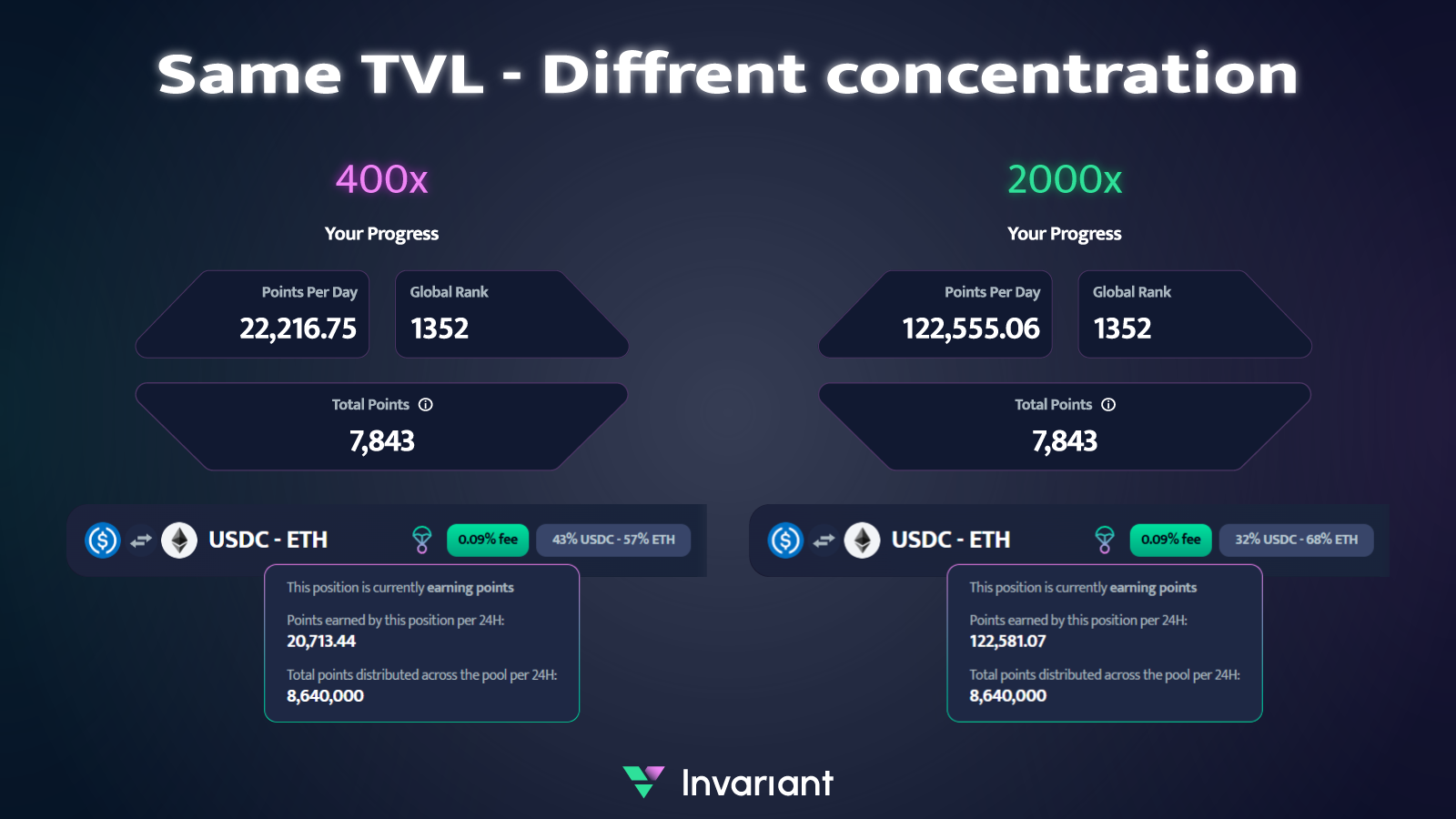

Here is a comparison of point earnings for the same position ($200 TVL) at two different levels of concentration.

See Your Points Before Opening a Position

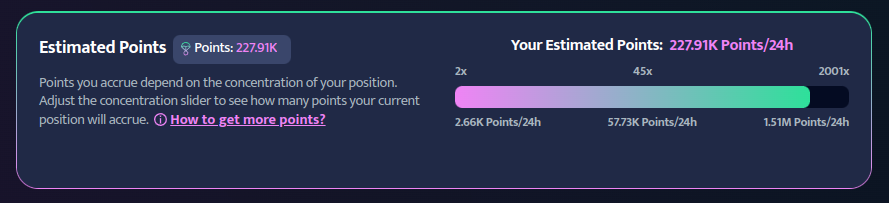

To make it easier for users to understand the power of concentration, we’ve introduced the Estimated Points feature. This tool allows you to see how many points your position can potentially earn before adding it to the pool.

By experimenting with different input values and adjusting the concentration bar, you can explore how various configurations impact your rewards. Use this feature to determine the optimal position that aligns with your point target and strategy.

Risks of Highly Concentrated Positions

While concentration offers many benefits, the associated risks are relatively small and manageable. It’s important to understand these risks to make informed decisions:

Common Misconception - Liquidation Risk

Many people mistakenly associate position concentration with the liquidation risks seen in futures trading. However, this is not the case. Concentrated liquidity provision operates entirely differently.

- No Liquidation Risk: Your assets are never at risk of being liquidated, regardless of market volatility.

Actual Risks

Impermanent Loss

This is always a factor in liquidity provision and occurs when the price of assets in the pool diverges. However, it’s generally a long-term consideration rather than an immediate concern

Price Moving Out of Range

If the price moves outside your chosen range, your liquidity becomes inactive.While you’ll stop earning fees and points during this time, the solution is straightforward. Rebalance your position to bring it back into an active range. More about it here.

Mastering concentration

Begin your journey with Invariant Points and master you concentrated liquidity skills today.

- Open a position using the concentration slider.

- Monitor and rebalance as needed.

- Stay active and refine your strategy.

In case of any problem join the Invariant community on Discord(link). Our team and experienced users are here to help!