Get started

In this tutorial, we’ll show you how to quickly open and manage your position on Invariant so you can start earning Invariant Points right away. Let’s get started!

Adding position

Let’s start by adding a liquidity position on Invariant.

1. Navigate to the Points Tab

2. Add liquidity to one of Rewarded Pools by clicking the “+” button

- APR (Annual Percentage Rate): The simple annualized return of your position, calculated without considering compounding.

- APY (Annual Percentage Yield): The annualized return of your position, including the effect of compounding over time.

- Fee: The fee tier of the pool. This is crucial to ensure you add liquidity to the correct fee tier. Adding liquidity to a non-recommended fee tier will not earn you points.

- Points per 24h: The fixed number of points distributed to all active positions in the pool over a 24-hour period.

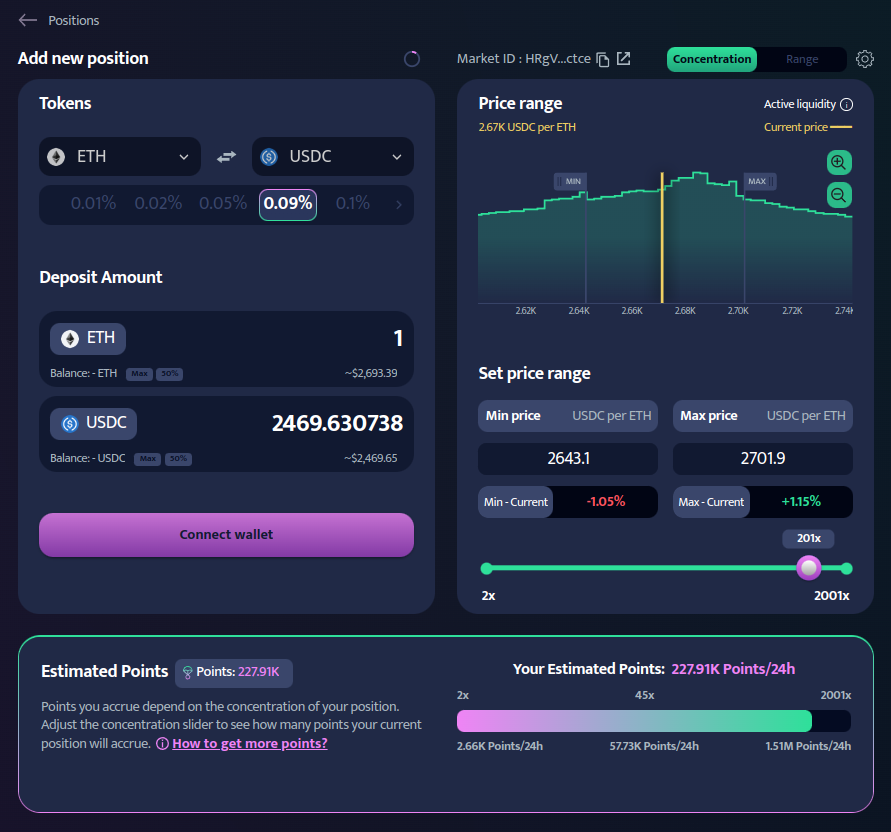

3. Add liquidity

After clicking “+”, you will be redirected to the liquidity addition window.

To earn points, pay special attention to two key factors:

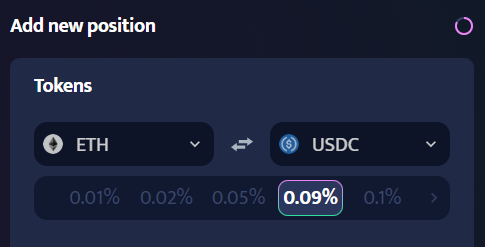

Fee Tier

Ensure you are on the correct fee tier. The fee tier eligible for points will be highlighted with a gradient border (as shown in the image below).

Concentration

This is the most critical aspect of providing liquidity. The right concentration level can significantly increase your points. If ranking high is important to you, familiarize yourself with the concentration mechanism described in detail here.

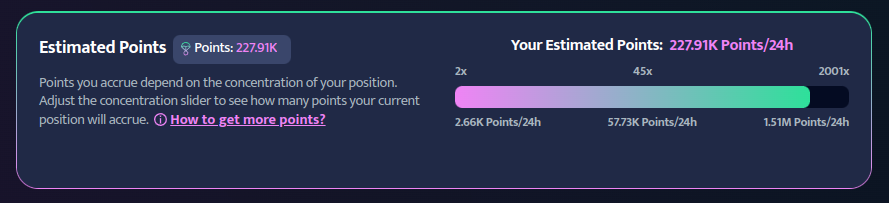

Estimated Points

Enter the amount of tokens you want to add to the pool, select the concentration range, and see an estimate of the points you'll receive after opening the position. Adjust the concentration slider to view the maximum potential points.

4. Check your position

Great! Now that you’ve added liquidity, you can view your new position in the Portfolio tab.

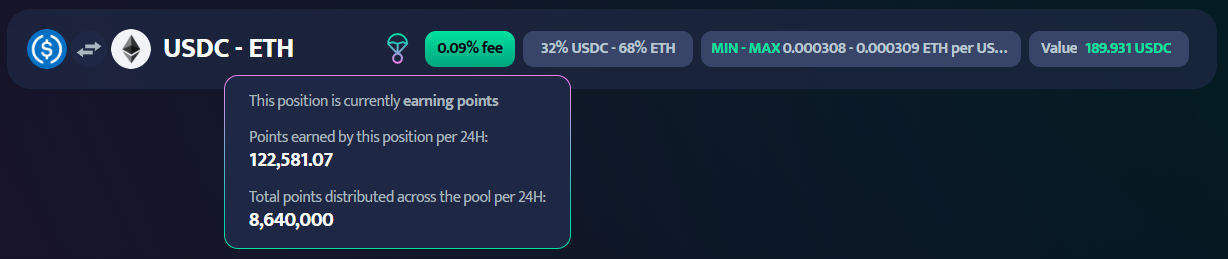

Position that is accruing points

Positions open in pools distributing points are marked with a colorful parachute icon. Hovering over it allows you to check how many points your pool is currently accruing.

Position that is not accruing points

If a position moves out of the set price range and stops earning fees and points, or if it was opened in a pool that doesn’t distribute points at all, the parachute will turn gray.

Managing position

Now, let’s move on to the most important aspect of concentrated liquidity provision—managing your position. The key is to stay within the designated range, but this can be challenging. Depending on your level of concentration, you may need to rebalance your position frequently. In this section, we’ll guide you through the process.

1. Check if Your Position Is in Range

Active liquidity (Position in Range)

This example shows active liquidity, meaning the position is within the set price range. This is the desired outcome, as you earn both swap fees and points. If your position is in range, there’s nothing you need to do other than monitor it to ensure it remains there.

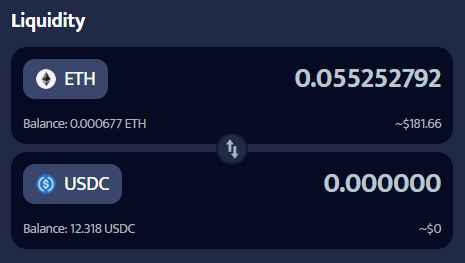

Inactive Liquidity (Position Out of Range)

This is an undesirable situation. The price has moved outside your set price range, rendering your liquidity inactive. It is no longer utilized in swaps, and you stop earning both fees and points. You will need to rebalance your position.

2. Rebalance Your Position

Let’s walk through the rebalancing process step by step.

Close Your Position (*Earned fees will be collected automatically)

Swap Your Tokens to Restore the Desired Ratio

As shown in the example, when your position falls out of range, the token ratio will shift depending on the direction of the price movement. To reopen your position, you must perform a swap to restore the desired token ratio based on your chosen level of concentration.

Reopen Your Position

Once you’ve restored the appropriate ratio for your desired concentration level, simply reopen the position. The rebalancing process is now complete.

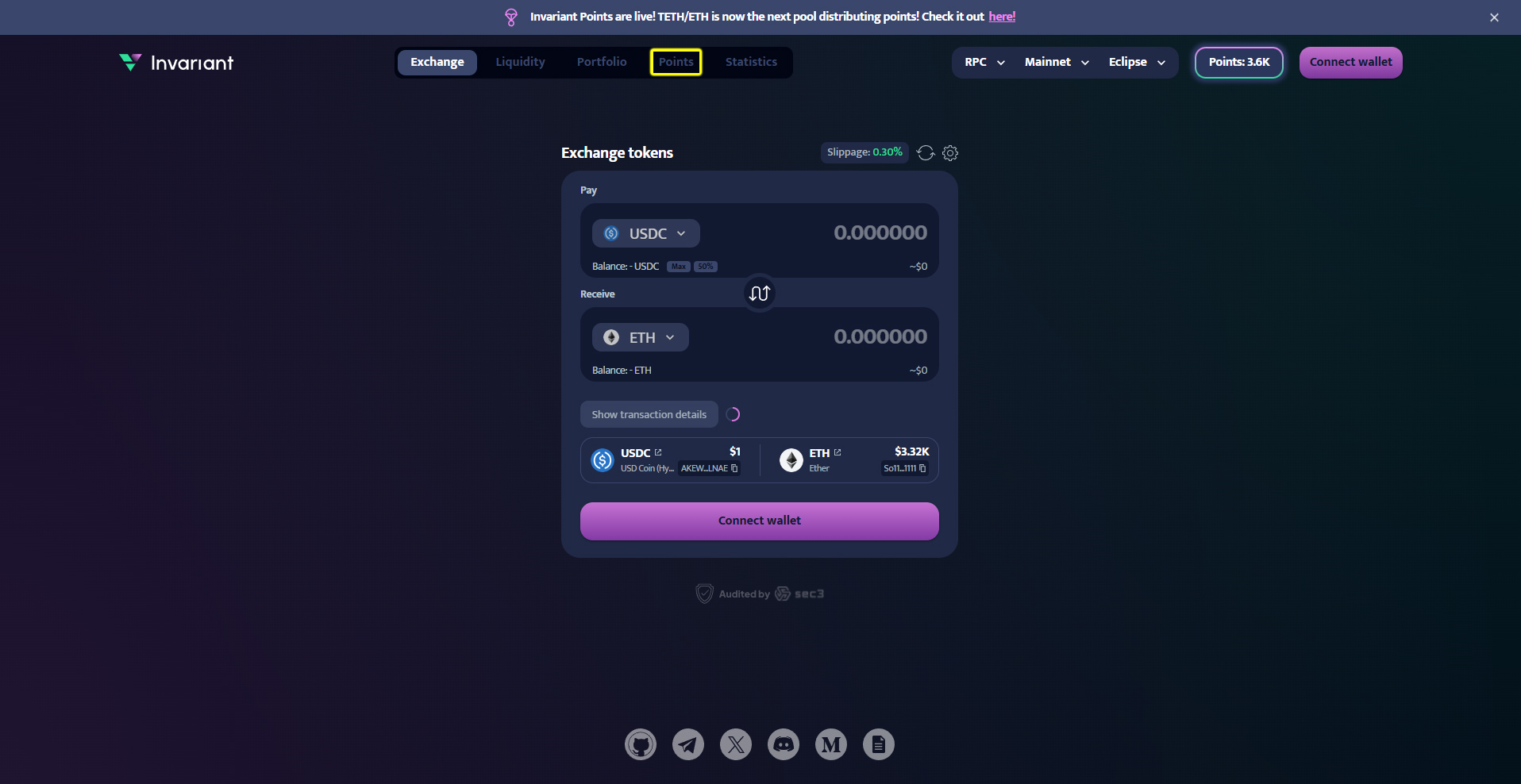

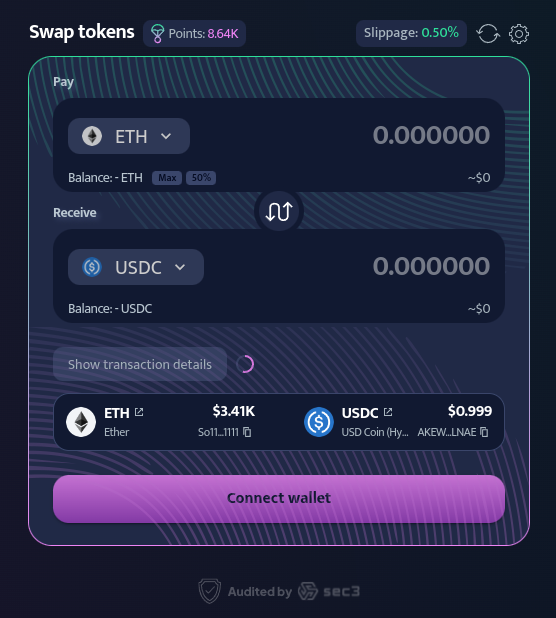

Making swaps

You can also earn points by making swaps on rewarded pairs.

1. Pick rewarded pair

Currently, points are distributed for swaps executed on the following pairs (all fee tiers apply):

Rewarded trading pairs are highlighted with a special graphic design to ensure users can easily identify whether they are swapping on a pair that earns points.

Pair with points

Pair without points

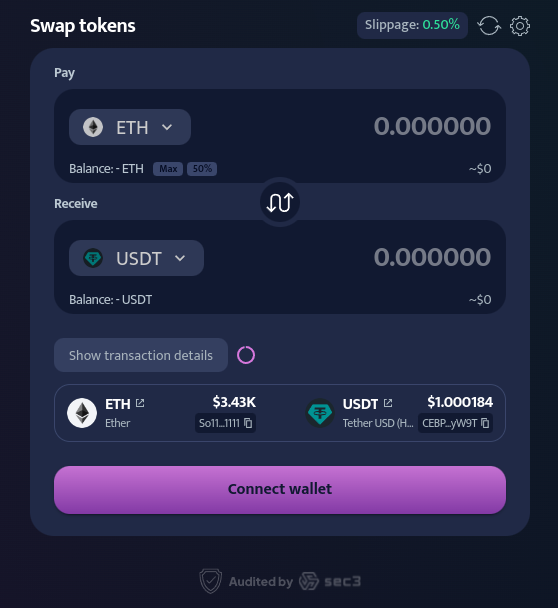

2. Make a swap

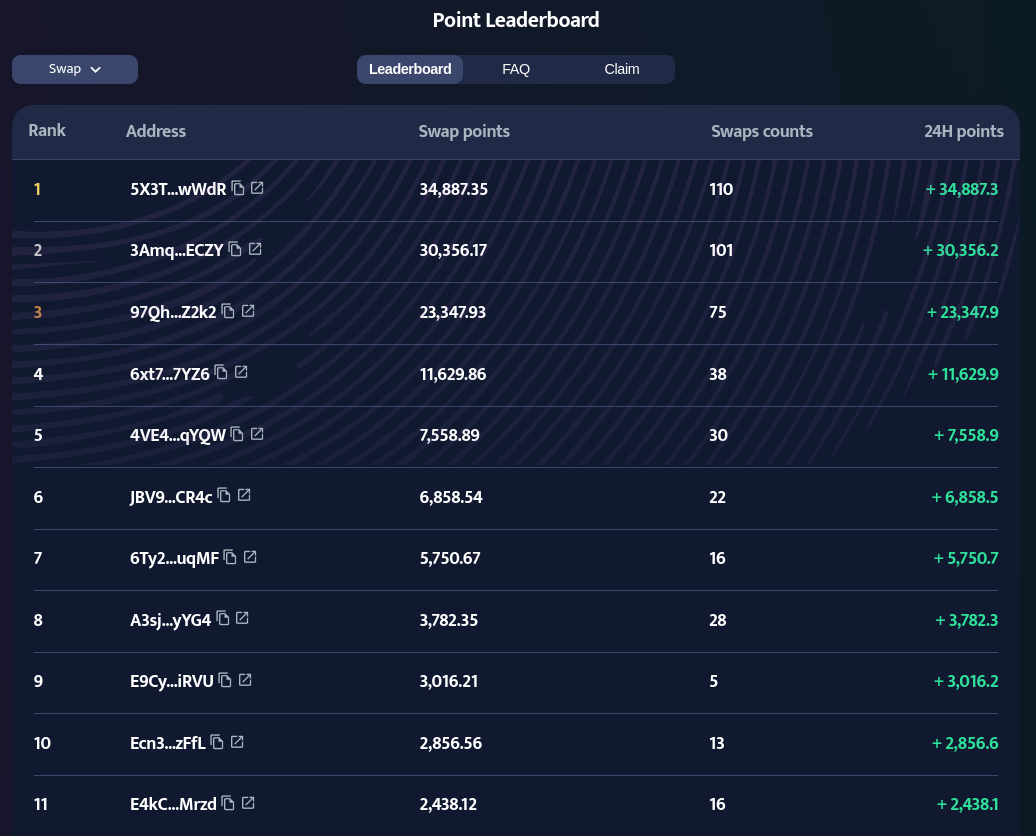

3. Check your position in the leaderboard

Go to the Points tab and scroll down to view the leaderboard.

Make sure you select the Swap Leaderboard from the list.

Find yourself on the leaderboard and climb your way to the top!