Single-Sided Liquidity

Adding single-sided liquidity is a powerful DeFi technique that many users overlook or don’t fully understand. Unlike the standard 50:50 setup (where you must deposit equal value of both tokens), single-sided liquidity lets you concentrate your liquidity entirely on one side of the pair, giving you more control over how your assets are used.

Think of it like setting a limit order on a traditional exchange: you’re choosing a price range where you’re willing to trade one asset for another. Outside of that range, you simply hold your chosen asset. It’s a bit like saying, "Will sell my USDC for ES only if ES drops to my target price range." This approach can be more capital-efficient and strategic, but it requires careful planning.

Quick tutorial step by step

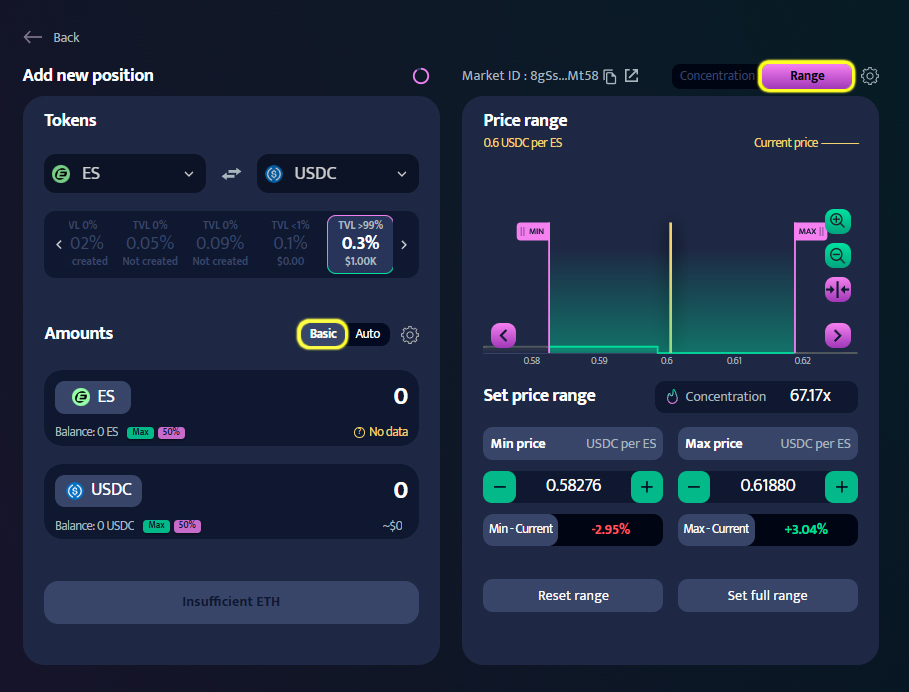

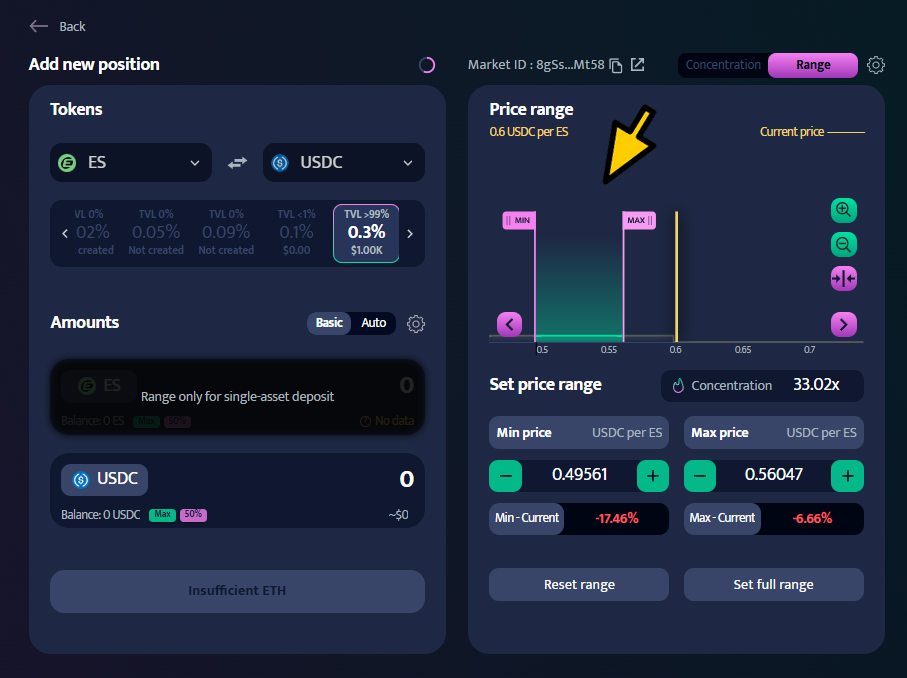

- Make sure you’re in "Range" mode and have AutoSwap set to "Basic", just like in the screenshot below.

- Take a look at the Current Price value, which is shown on the chart as a vertical yellow line. We’ll be setting up single-sided liquidity relative to this value. The Current Price for the ES token is currently set at 0.6 USDC.

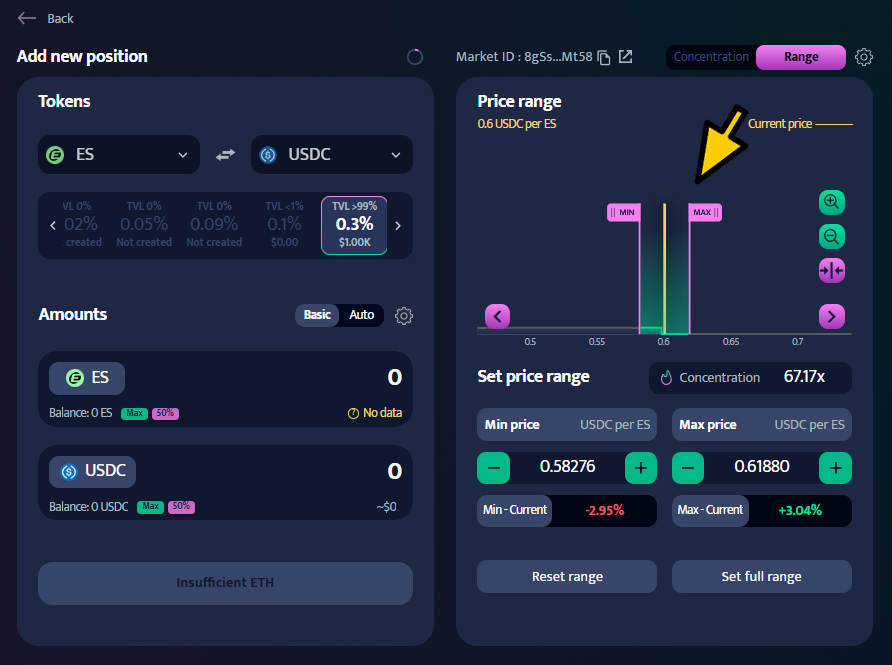

- The default range is distributed symmetrically around the Current Price. In this setup, you get a 50:50 ratio, which means you need to add equal value of both tokens. To provide single-sided liquidity, the "MIN" and "MAX" indicators must be positioned to the left of the line marking the Current Price.

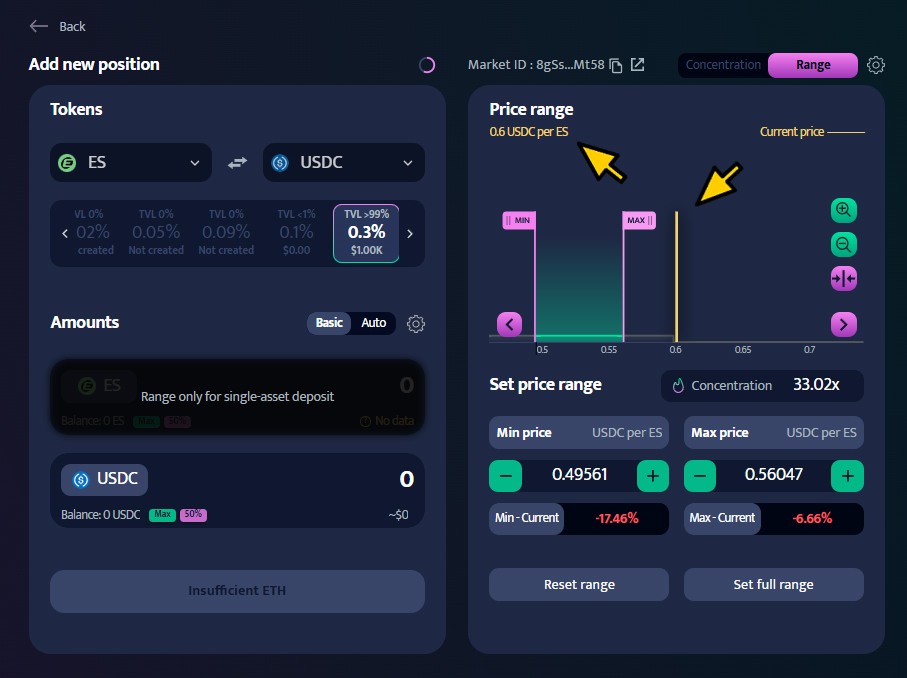

- As you can see in the screenshot below, I’ve set the price range around $0.49–$0.57. How will my position behave now and after the ES token launch? Let's break it down.

Currently – The position will remain inactive because trading for ES hasn’t started yet.

After TGE (starting price $0.6) – Trading for the ES token has started, but its price is outside my price range. The position remains inactive.

After TGE (price drop to $0.56) – The position becomes active because the market price of ES has entered my price range. Part of the USDC I previously added to the position gets swapped for ES tokens. Current position ratio: USDC 85:15 ES.

After TGE (price drop to $0.53) – The position is active, and the ES price is now exactly in the middle of my price range. More of the USDC I added earlier gets swapped for ES tokens. Current position ratio: USDC 50:50 ES.

After TGE (price drop to $0.48) – The position is inactive because the ES price is now below my price range. All of the USDC I added earlier has been swapped for ES tokens. Current position ratio: USDC 0:100 ES.

What happens if the ES price starts going back up? The same process, just in reverse: if the price moves above my price range, the position will shift back to 100% USDC, just as it was when it was originally added. Meanwhile, I will be earning a significant amount of fees, especially when the price is volatile, as well as Invariant Points thanks to adding single-sided liquidity ahead of other users.