Single token LP

Concentrated liquidity introduces an interesting feature: the ability to provide liquidity with only one token, instead of needing to deposit both tokens from a pair. This is possible because liquidity providers (LPs) can choose a specific price range where they want their liquidity to be active.

How does it work?

In a traditional liquidity model, LPs must provide equal value of both assets in a trading pair (for example, 50% ETH and 50% USDC). However, with concentrated liquidity, LPs can focus their liquidity within a specific price range. This feature allows for what's known as single-sided liquidity.

Single-Sided Liquidity Single-sided liquidity means that instead of providing both tokens (ETH and USDC, for example), you can choose to provide liquidity with just one token, depending on the price range you select:

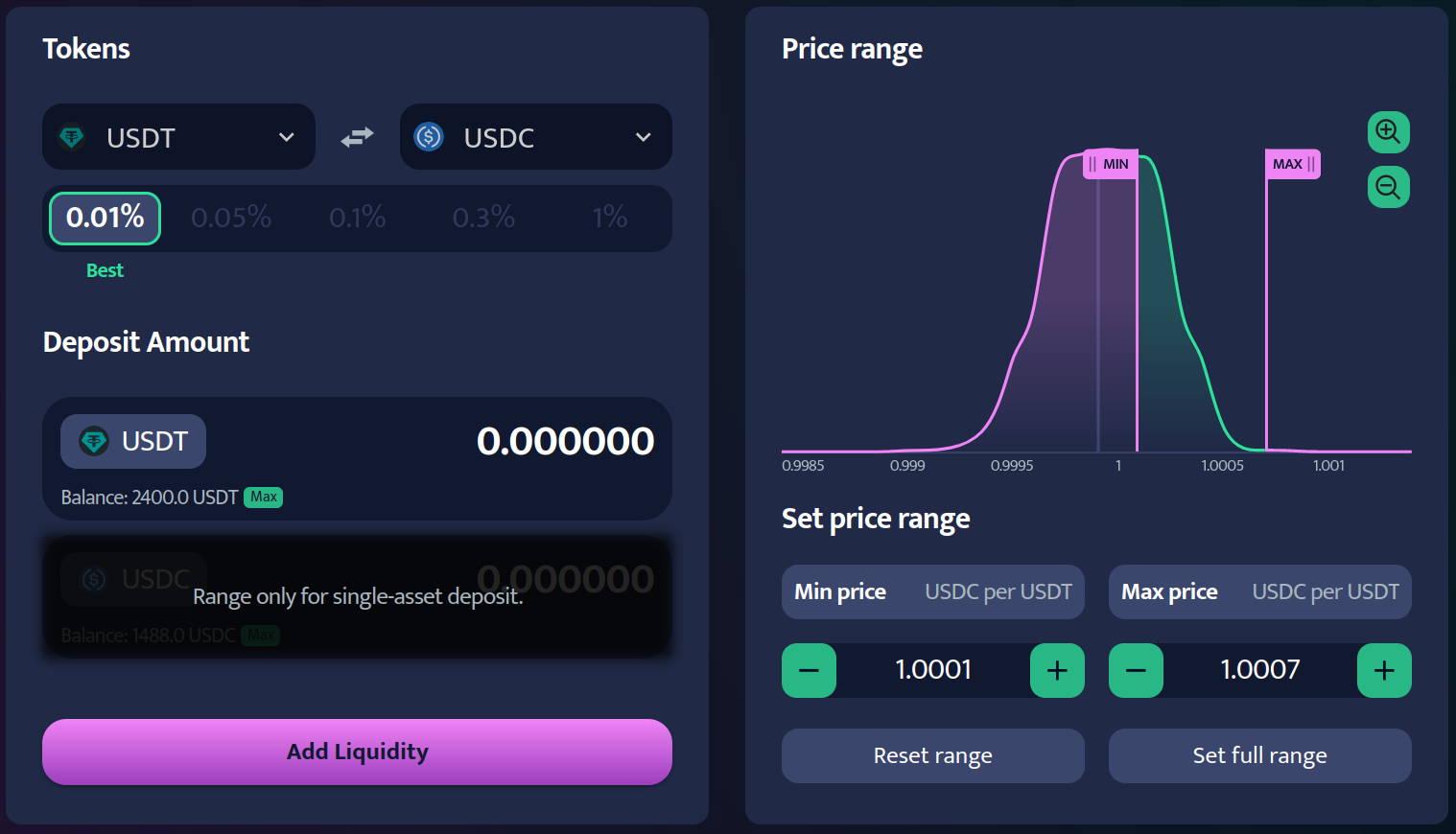

If the price range is below the current price, you can deposit only the base token (e.g., ETH). If the price range is above the current price, you can deposit only the quote token (e.g., USDC). In either case, your liquidity is concentrated and will only be active when the price enters your chosen range.

What’s the benefit?

When price will enter in your chosen range, you will start earning, even though you only provide one token

In conclusion, concentrated liquidity and single-sided liquidity open up new strategies for liquidity providers, allowing them to be more selective with their capital, reduce exposure to multiple assets, and potentially increase their returns.