Math

The Bonds, are price mechanisms that tries to sell tokens at a predetermined rate over a specified period of time. Assume a Seller wishes to sell one token in exchange for a another one. BondSale is launched by the seller, who configures five variables:

| Variable | Description |

|---|---|

bond_amount | The amount of tokens that the Seller wishes to sell. of token which Seller want to sale. |

floor_price | Minimal (and starting) price of a selling token. |

sale_time | BondSale exists at this time. |

up_bound | Defines the percentage difference between ceil price and floor price. |

velocity | Defines how quickly prices fall over time. |

For each trade, we call the function

/src/math.rs

pub fn calculate_new_price(

bond_sale: &mut BondSale,

current_time: u64,

buy_amount: TokenAmount,

) -> Decimal {

let delta_time = current_time - bond_sale.last_trade;

let sale_time = bond_sale.end_time - bond_sale.start_time;

let time_ratio = Decimal::from_integer(delta_time.try_into().unwrap())

/ Decimal::from_integer(sale_time.try_into().unwrap());

let delta_price = bond_sale.velocity * bond_sale.up_bound * bond_sale.floor_price * time_ratio;

let supply_ratio = buy_amount.percent(bond_sale.bond_amount);

let price = match { bond_sale.previous_price } < { bond_sale.floor_price + delta_price } {

true => bond_sale.floor_price,

false => bond_sale.previous_price - delta_price,

};

let jump = supply_ratio * bond_sale.up_bound * bond_sale.floor_price;

bond_sale.previous_price = price + jump;

bond_sale.remaining_amount = bond_sale.remaining_amount - buy_amount;

bond_sale.last_trade = current_time;

price + Decimal::from_decimal(50, 2) * jump

}

where current_time measures how much time has passed

since the start of the bonds and buy_amount is how much trader wants to buy.

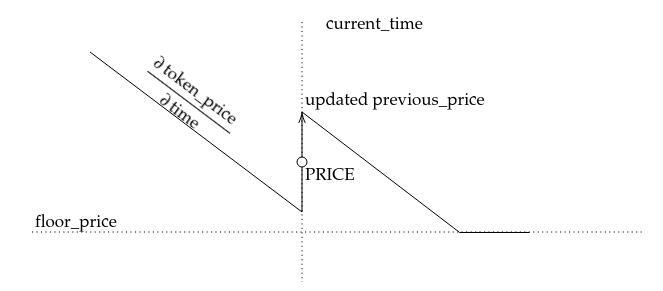

Locally, in trade_time, the price chart looks like this: